How Open Banking will transform Credit in Nigeria: Audience Q&A

We had a vibrant turnout at our recent webinar, “How Open Banking will transform Credit in Nigeria,” with dozens of questions from professionals across banking, fintech, and policy. Below is a detailed Q&A covering everything from payments and privacy to infrastructure and cross-border insights. Whether you missed the session or want to dive deeper, here’s […]

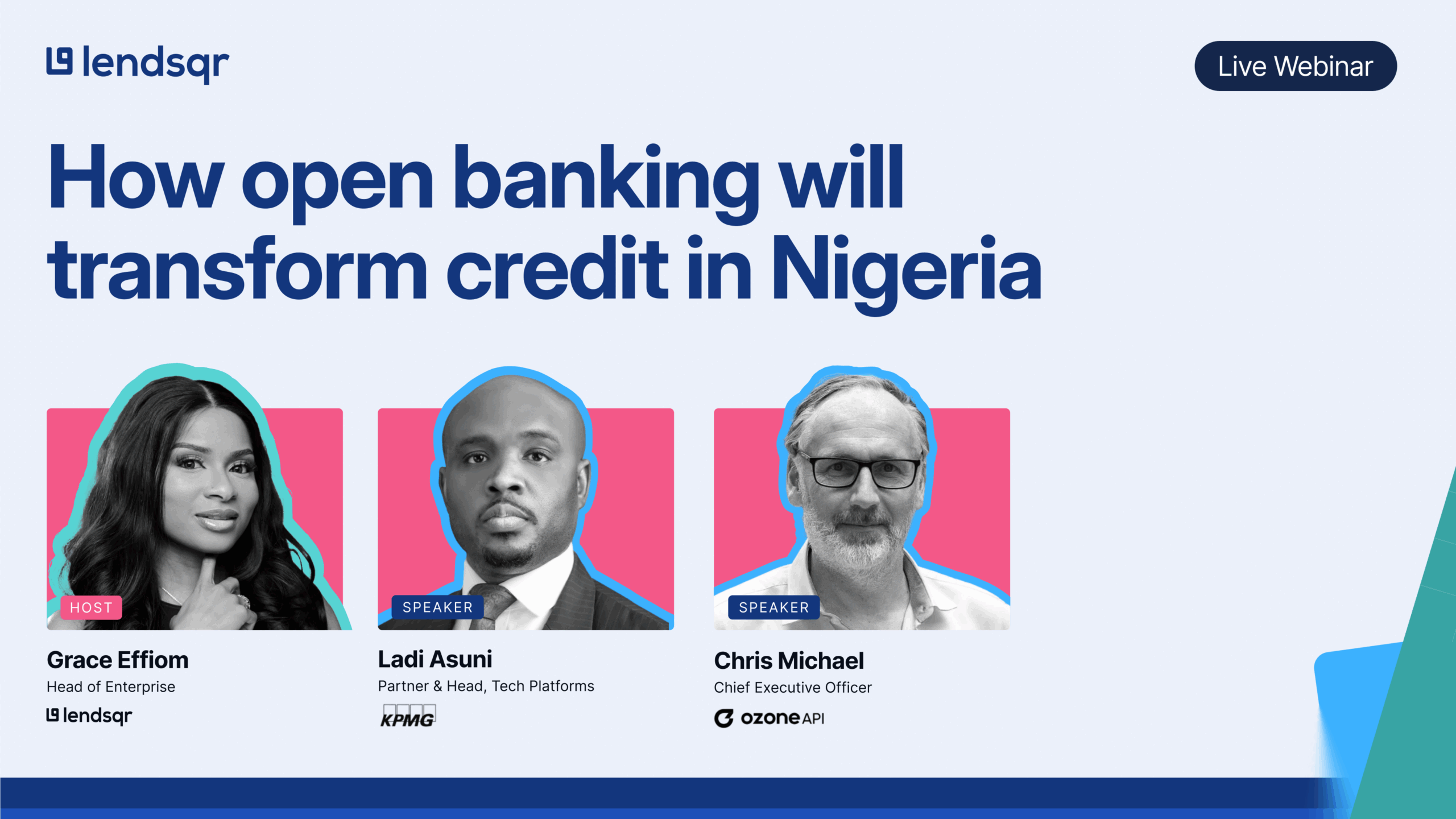

How Open Banking will transform Credit in Nigeria

On May 29, 2025, Lendsqr hosted an illuminating webinar titled “How Open Banking will transform Credit in Nigeria.” With over 100 attendees from Nigeria’s fintech, banking, and consulting sectors, this session brought together two global experts: Chris Michael, CEO of Ozone API and current lead on several open finance initiatives, and Ladi Asuni, Partner & […]

3 African countries making progress in Open Banking

Right now, your bank holds all your financial data: how much you earn, what you spend, your loan history, and more. Open Banking changes that.

Open banking in Africa: Continental progress made as of 2025

In London or Sydney, open banking was about breaking up bank monopolies. In Africa, it’s about building the pipes. Basic ones. The kind that lets people send money, access credit, or even check a bank balance without friction. Here, open banking isn’t just a policy play, it’s a workaround. A way to fill gaps that […]

What you need to know about Nigeria’s Open Banking

Two years after the first Open Banking framework circular was released, the CBN issued operational guidelines for Open Banking on Tuesday, March 7, 2023, heralding a start for what many anticipated would bring about a much-needed change in financial services.