How to get a student loan in the US as an African immigrant

Navigating student loans in the U.S. as an African immigrant feels like a complex process. In this guide, we'll help borrowers understand the ins and outs of American finance to aid them in their loan application.

How Africans can use MPower to finance their student loans in the US and Canada

If you’re serious about studying in the U.S. or Canada, this article is an in-depth exploration of how African students can effectively access MPOWER loans, what the process truly entails, and the often-overlooked details that can make the difference between approval and delay.

Musoni does your banking. But what about your lending?

While Musoni handles some banking and operational functions, the lending side requires much more than just having a system to record loans.

Your core banking system isn’t your loan management system. Here’s the difference

If you have spent any meaningful amount of time in lending, you have likely heard someone ask the question, “Can’t our core banking system handle loans too?” On the surface, it seems like a fair point. Loans are essentially account balances. When a customer takes out a loan, the system records the disbursed amount as […]

How to get the best out of Mifos? Pair it with Lendsqr

While Mifos excels at managing the back-end ledger and core banking functions, it does not offer a full suite of tools that modern digital lenders require to operate competitively.

BNPL vs. traditional loans: What works best for US immigrants?

BNPL and traditional loans aren’t inherently good or bad for immigrants, the real challenge is navigating systems that weren’t designed with their realities in mind. What matters most isn’t which product you pick today, but how each decision fits into a broader plan to build autonomy and survive in the U.S. economy, and own your place in it.

MPowa Finance vs Wonga: which is the best in South Africa

The truth is that neither is perfect. MPowa is strict but fast. Wonga is flexible but requires proof. Choosing between them isn’t about which app sounds better, but which one fits your financial reality?

How to reduce loan defaults in Liberia: Best strategies for lenders

When we talk about loan defaults in Liberia, what usually comes to mind is poverty or bad borrowers. But beneath the surface, there are ignored factors that quietly make things worse. In this article, we explored the reasons behind Liberia’s loan default challenge and workable strategies that lenders can use to protect their portfolios while still empowering the people they serve.

Where to get loans in Zambia without collateral

Getting a loan in Zambia shouldn’t require land titles, paperwork from 1997, or begging your employer for a letter. Thankfully, several modern lenders are offering clean, fast, no-collateral loans to help Zambians access credit without drama. With over 60% of Zambians still don’t have access to formal credit, there are just more than enough Zambians […]

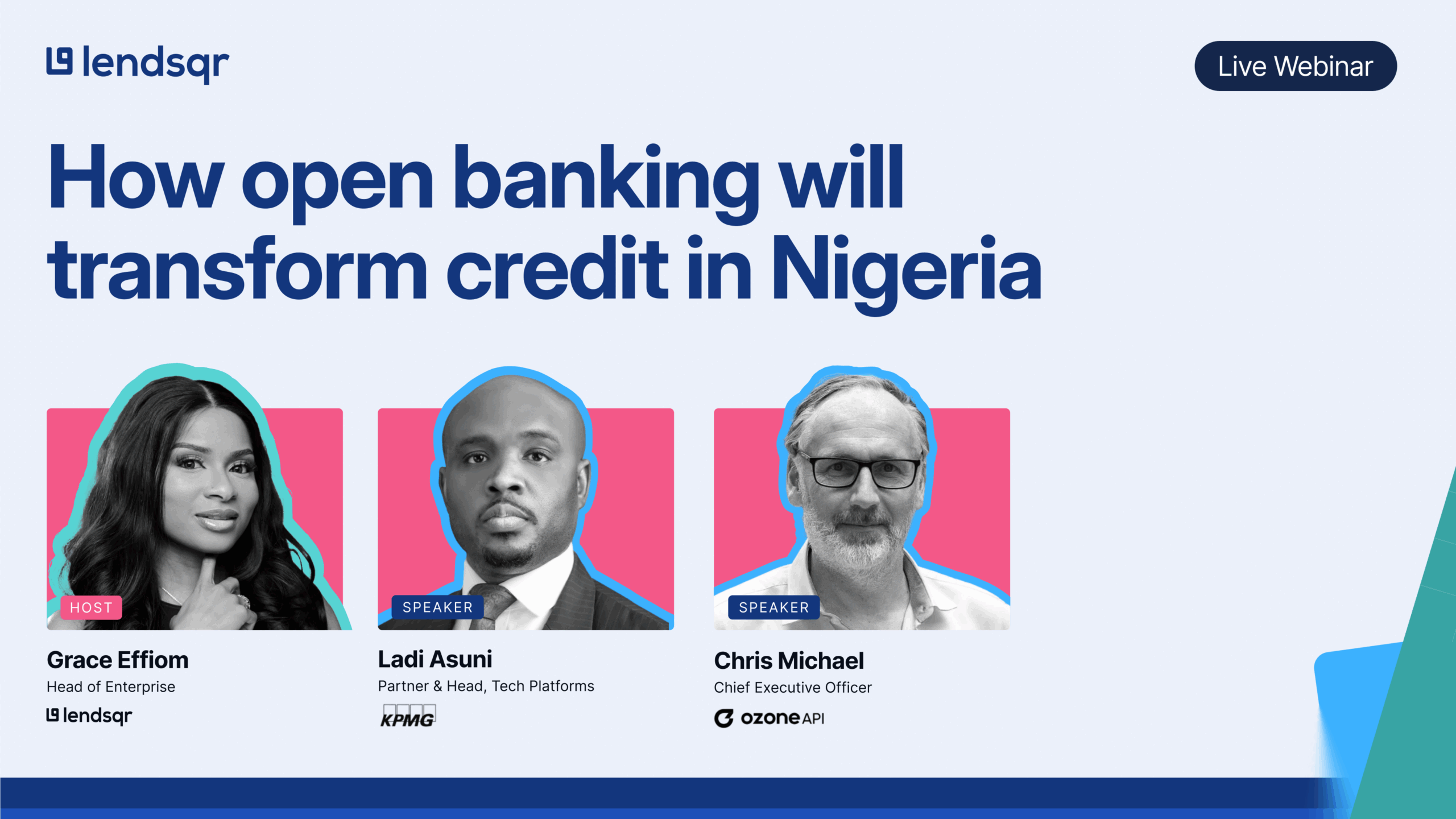

How Open Banking will transform Credit in Nigeria: Audience Q&A

We had a vibrant turnout at our recent webinar, “How Open Banking will transform Credit in Nigeria,” with dozens of questions from professionals across banking, fintech, and policy. Below is a detailed Q&A covering everything from payments and privacy to infrastructure and cross-border insights. Whether you missed the session or want to dive deeper, here’s […]

How Open Banking will transform Credit in Nigeria

On May 29, 2025, Lendsqr hosted an illuminating webinar titled “How Open Banking will transform Credit in Nigeria.” With over 100 attendees from Nigeria’s fintech, banking, and consulting sectors, this session brought together two global experts: Chris Michael, CEO of Ozone API and current lead on several open finance initiatives, and Ladi Asuni, Partner & […]