A look back at 2024 and what’s coming in 2025 🚀

“Success is not final, failure is not fatal: It is the courage to continue that counts.” – Winston Churchill As we step into this new year, we want to take a moment to reflect. 2024 was a remarkable year for us at Lendsqr, filled with achievements, valuable lessons, and opportunities for growth. We’re confident that […]

🔄 What happens when life hits your borrowers?

Hello there! 👋 Hello, and Happy New Month! 🎉 November is here, reminding us that while the year may be winding down, the opportunities are not. As the days grow shorter, the chance to expand your lending business is still within reach. Whether you’re considering introducing new loan products, fine-tuning your existing ones, or embracing […]

Lidya vs Evolve Credit vs Lendsqr

After exploring each of these platforms thoroughly, here's how the Lidya vs. Evolve Credit vs. Lendsqr showdown turned out.

6 practical tips to reduce loan processing times

Fast loan processing doesn’t mean approving all loan requests, but deciding if a loan should be approved or not shouldn’t take forever.

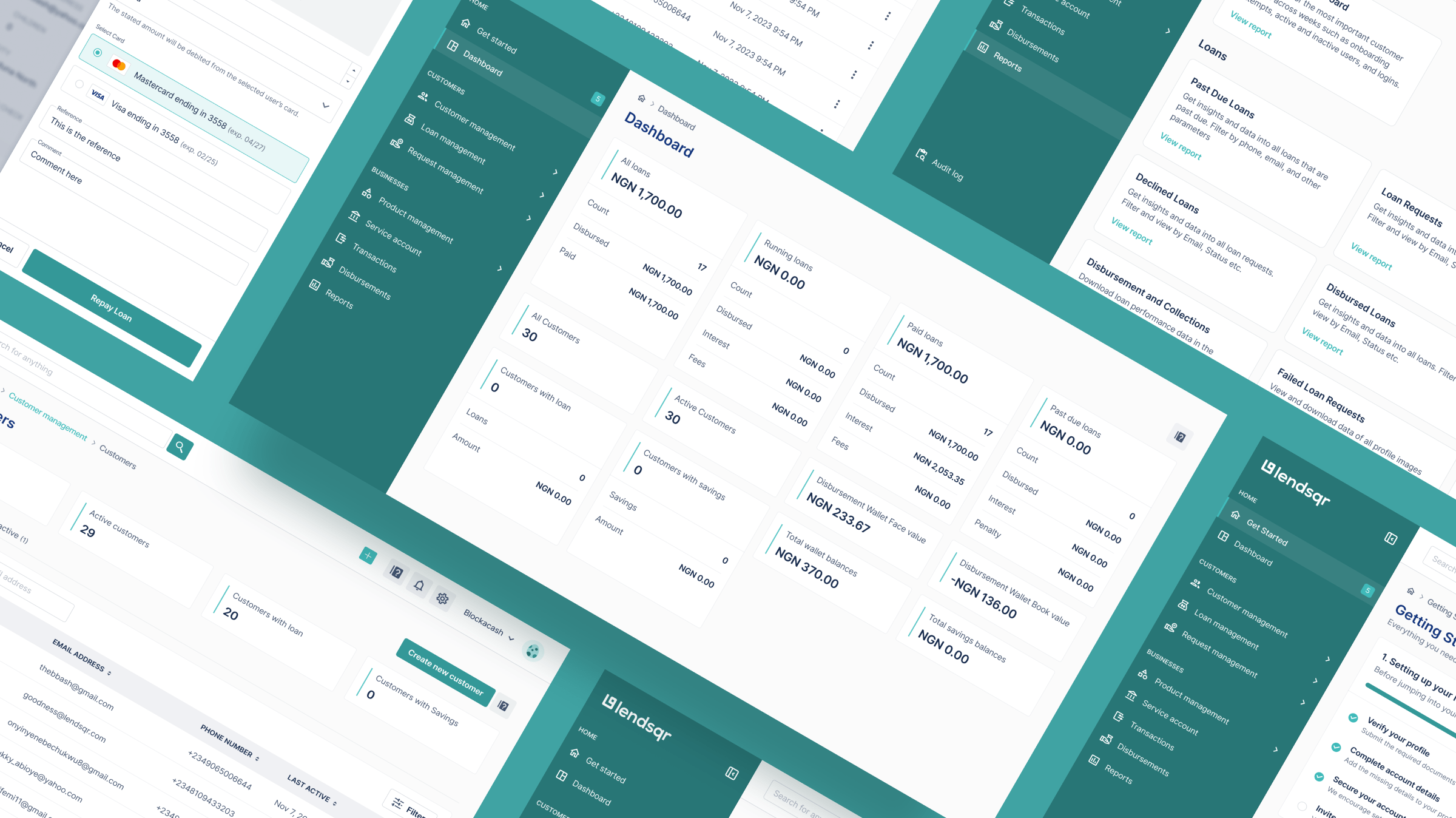

10 intriguing facts about Lendsqr

Lendsqr is way more than a loan management platform. At the core of our services is a story. One woven with threads of innovation and, some might say intrigue.

What collateral do you need to protect your loan business?

Lenders need to be smart about what kind of collateral they accept, but they also want to make sure that all sorts of businesses and people have a chance to get the loans they need to grow.

How to use Route Mobile with Lendsqr for sending SMS

Once you have your Route Mobile API key, log in to your Lendsqr account. Reach out to our product support team at support@lendsqr.com and get set up in 10 minutes.

How we use Metabase to power our internal reporting

Metabase team deserves immense credit and we, at Lendsqr, are incredibly grateful to them. Their open-source platform is one of the best things we've ever gotten for free from the open source world.

How we built our URL shortener (Monstrator) as a replacement for Bitly

Monstrator stands as a testament to our in-house development capabilities, demonstrating our ability to solve critical business problems with custom-built solutions.

How to use Infobip with Lendsqr as an SMS provider

Lenders can enjoy the best of both worlds: Lendsqr's powerful loan management software combined with Infobip's superior SMS infrastructure.

How to use Loandisk with Lendsqr

Instead of choosing between Loandisk and Lendsqr loan management systems, lenders can access everything from unified platforms, having the best of both worlds.