Credit bureaus not enough? Try these alternatives

Credit bureaus are supposed to be the backbone of the lending process, yet they often fall short. Let’s explore three other alternatives

4 reasons why most loan defaulters are fraudsters

It’s time we stop sugarcoating this. Loan defaulters, in many cases, are fraudsters and here’s how they reveal themselves as such.

5 issues that lenders have with Nigerian credit bureaus

Before Nigerian credit bureaus were created, banks operated as lone wolves, reluctant to share credit information with third parties. They also didn’t have ways of knowing if a borrower had unpaid loans with other banks/financial institutions. As such, borrowers could easily secure multiple loans and cart away funds from different institutions without the lenders knowing. […]

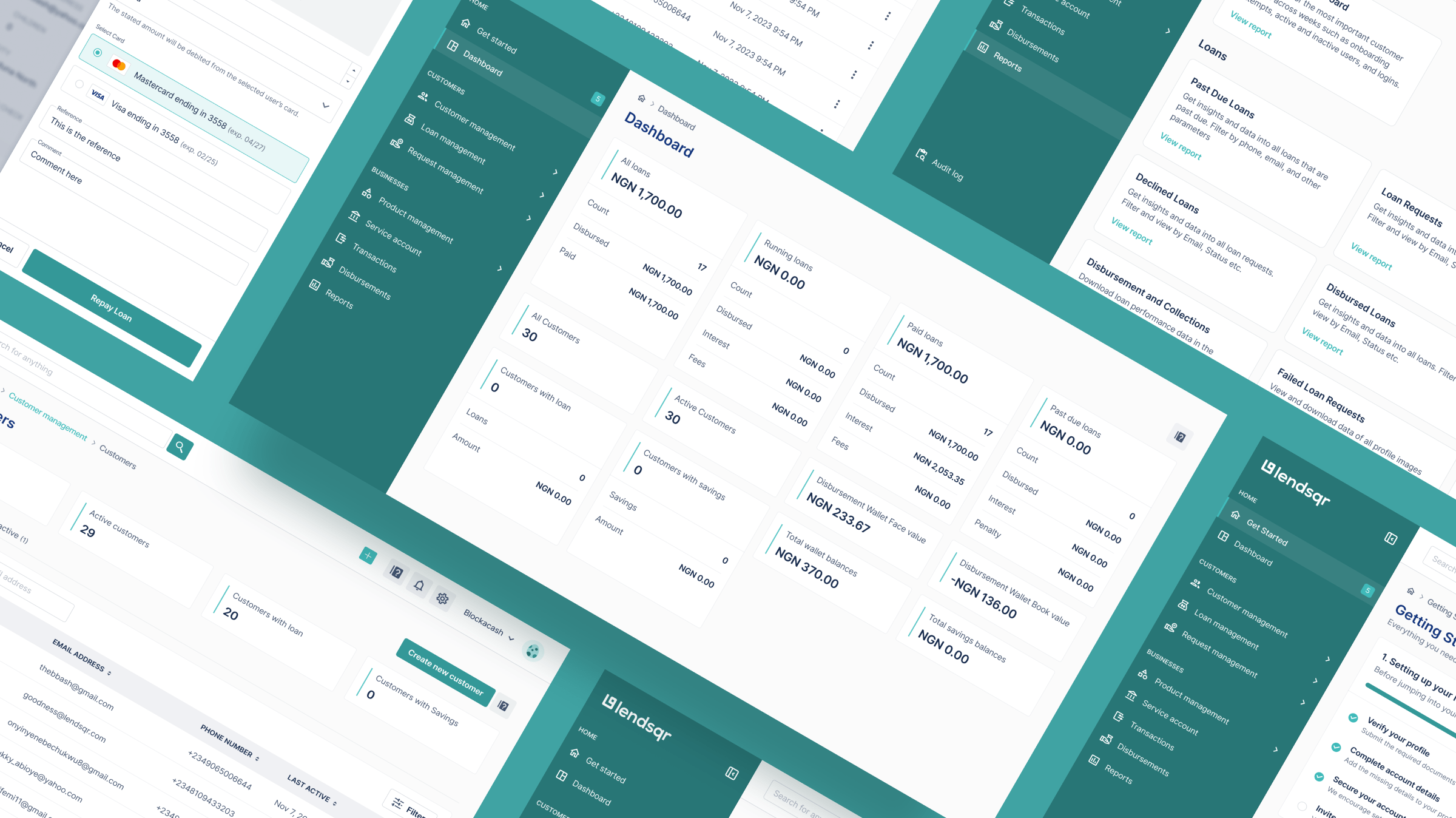

Build your own web and mobile apps with our core services API

At Lendsqr, we are continuously committed to making lending seamless and reducing the credit gap by providing technology that empowers you to offer credit to underserved populations one country at a time.

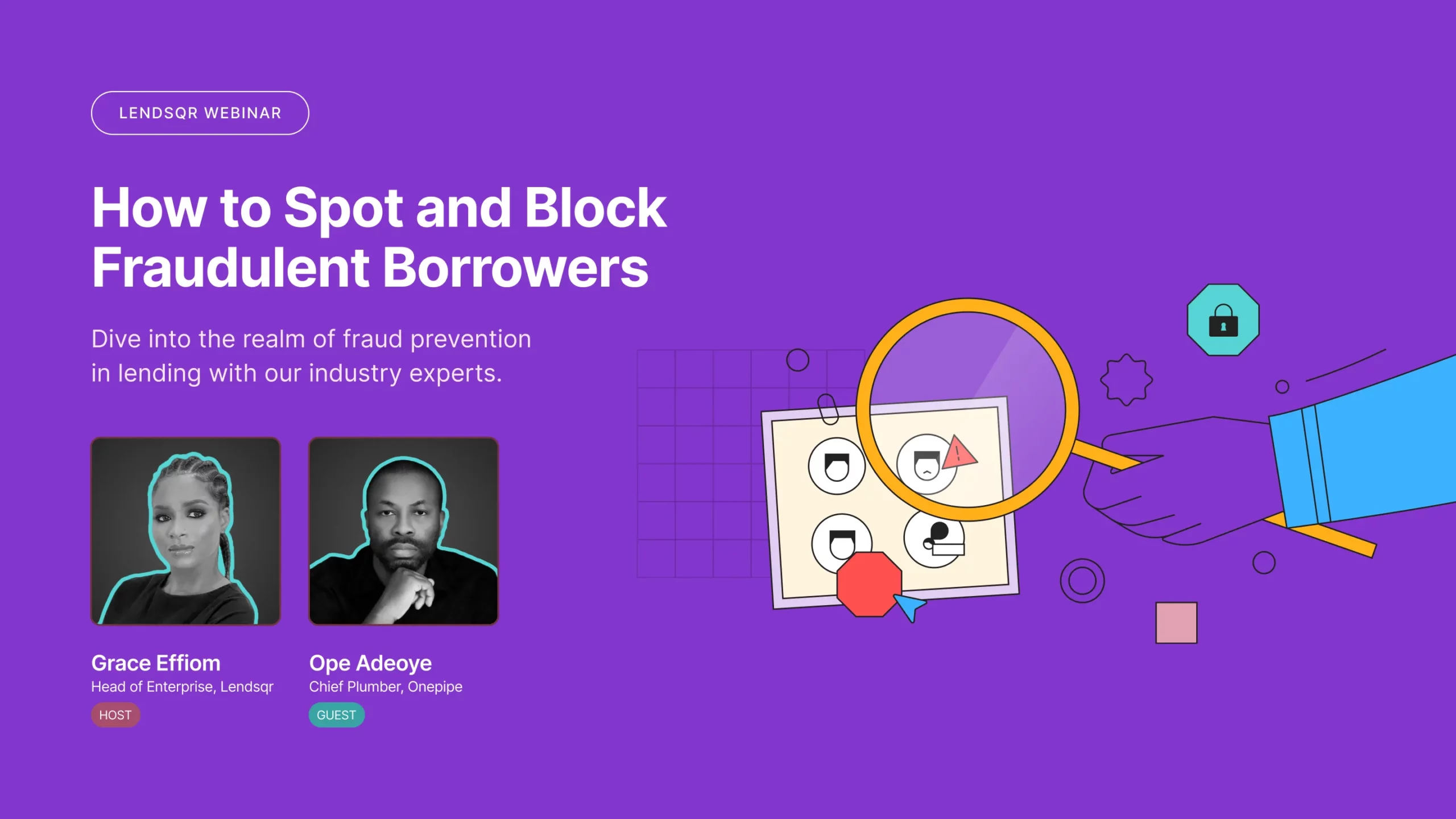

How to spot and block fraudulent borrowers

Grace Effiom, the Head of Enterprise at Lendsqr, hosted a webinar featuring Ope Adeoye, CEO of OnePipe, where they discussed the latest approaches to combating fraud in the digital lending space.

Offline lending vs online lending: pros and cons

Not to declare one better than the other, but offline and online lending have their benefits and drawbacks.

How to secure your MFB license in Nigeria

When it lending is large-scale, the options are usually finance houses and MFBs. Today, we’ll cover the processes and requirements to obtain the MFB license.

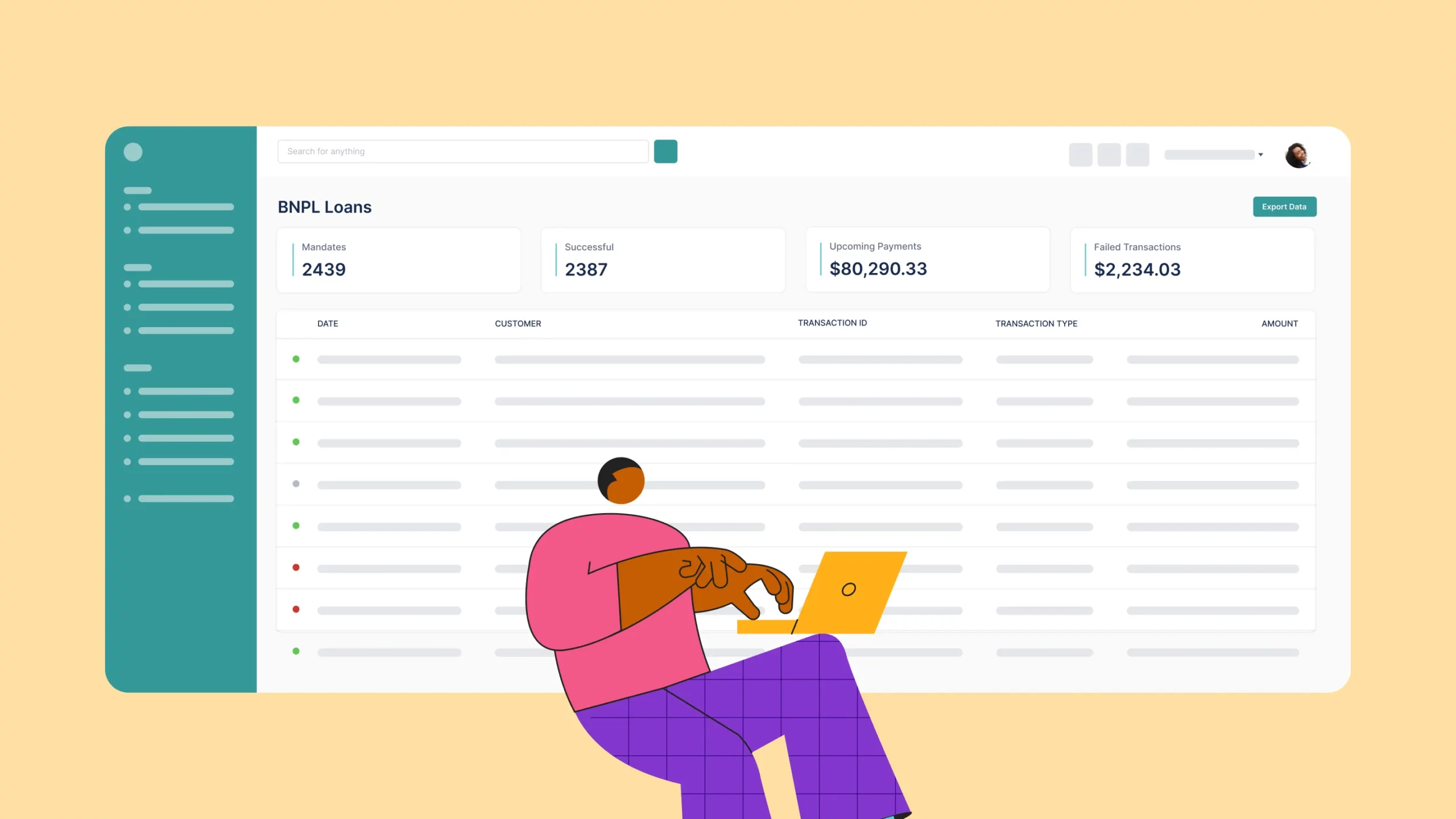

Embed BNPL into your platform without becoming a lender

It’s frustrating to know you could make the sale if only your customers had more payment options. This is where Buy Now, Pay Later (BNPL) comes in.

Are you still chasing payments? Direct debit can turn your loan collections around

Why endure the headache of chasing payments when direct debit can do the hard work for you?

Paycient Finance is transforming healthcare with credit

Thanks to Lendsqr, Paycient Finance was able to reach more healthcare providers and close the funding gap in Nigeria’s healthcare sector.

Starting lending in Canada? Here’s how to get licensed

Getting a lending license in Canada involves understanding federal and provincial regulations because each has its own requirements.