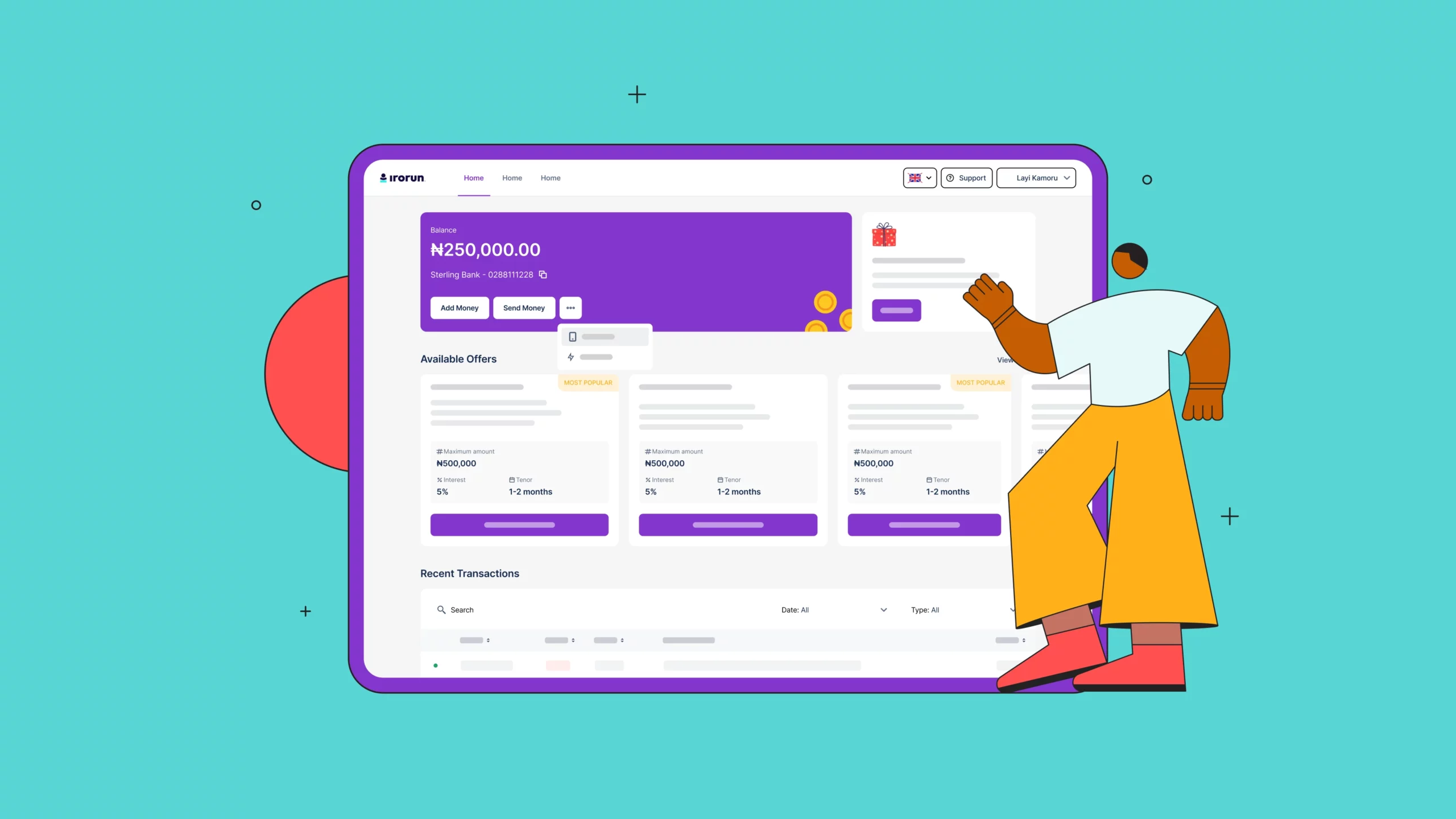

Why we built our lenders’ web app and how it has changed lending forever

“It’s going to change lending forever and we’re not ashamed to say we will be the ones to do that.” Adedeji Olowe, Founder, Lendsqr

What is on-lending and how does it work?

While there are several ways to finance a lending business, on-lending remains one of the most underutilized methods, likely due to a lack of information.

5 key qualities borrowers look for in a lender

While countless articles detail what lenders want in a borrower, we've flipped the script to highlight what borrowers look for in a lender. So, what qualities convince a borrower that a lender is the right choice?

Finance house vs. Microfinance: An overview of digital lending license

To operate a lending business in Nigeria, you must get a license. Figuring out which license suits your needs can be tricky. So, it's necessary to understand what each license allows and doesn't allow.

4 ways in which Lendsqr wants to use AI for lenders

What if we could develop an AI tool for lenders to quickly sift through the information and make decisions easier and quicker?

6 features in your loan app that chase borrowers away

Let's explore these potential red flags and how to ensure your loan app attracts, rather than repels, the very customers it aims to serve.

How to use Monnify with Lendsqr for loan repayments

Ensure smooth loan repayments with Lendsqr's integration of Monnify, one of Africa's reliable payment gateways for seamless transactions and minimized losses.

What is debt forgiveness and how does it work?

If you reside in a country where debt forgiveness programs exist and are struggling to cover debt payments or feel like you’ll never be able to pay everything off, you might consider debt forgiveness an option.

What is rent reporting and why is it important in Nigeria?

Many people who don’t have much credit history do have a history of paying rent on time. But that information doesn't show up on their credit reports or help their credit scores. However, with rent reporting, everything changes.

The punishments and disadvantages of having a bad credit score

A bad credit score could be a hidden burden, making it harder to get the things you need financially and leading to unexpected problems.

What to consider when setting up a payday loan software

Payday loans are short-term loans that help borrowers bridge the gap between paychecks. Essentially, a Payday loan is any loan that’s tied to a salary date. Now, let’s take a look at some things to consider when setting up payday loan software