How AI Agents will empower lenders

Earlier this year, Lendsqr set out to test how well a generative AI could support its internal teams. Using OpenAI’s custom GPT, they created a Lendian GPT specifically for their Product Support team, and it worked like a charm.

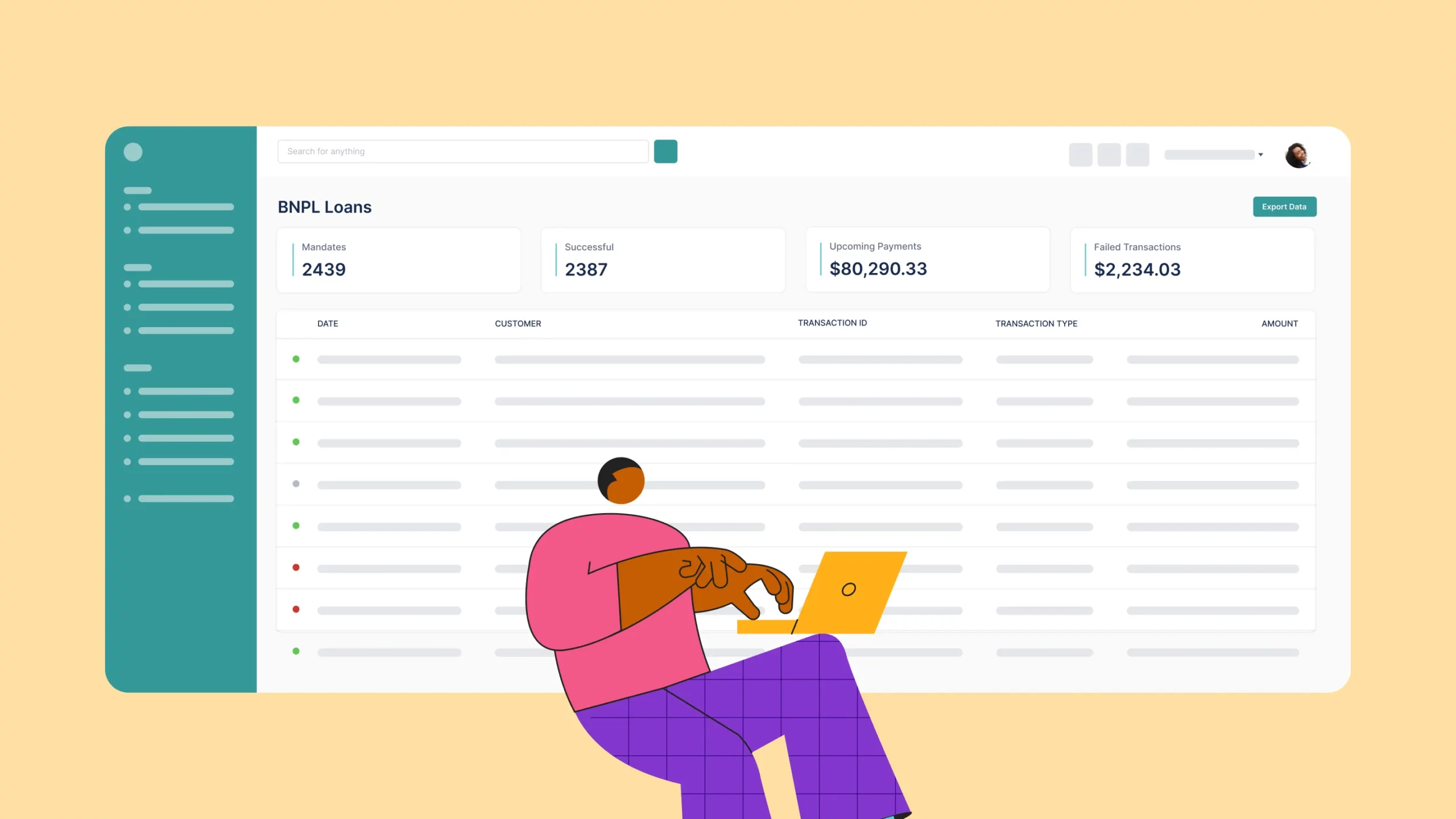

Embed BNPL into your platform without becoming a lender

It’s frustrating to know you could make the sale if only your customers had more payment options. This is where Buy Now, Pay Later (BNPL) comes in.

Essential lending APIs for every lender

To keep up with the demand for fast, personalized service, lenders need to speed up their processes and use more data to meet customer expectations. That’s where Application Programming Interface (APIs) comes in.

3 best React Native alternatives for building mobile loan apps

In the world of mobile app development, there are many ways to skin a cat, and React Native is one of them.

What are lending APIs and how do you get them?

Lending APIs are specialised APIs within the financial system designed specifically for lenders, who use them in part or in whole to decide loan approvals, onboard new borrowers, disburse loans, and collect repayments.

What you need to know about blacklists

A blacklist is an organized list that records the details of individuals who have engaged in misconduct. And there are so many blacklists all over the world. Today, we talk about KARMA.

How we built Oraculi to help lenders make informed decision

At the core of any loan management software is a decisioning system that helps a lender decide whether a loan should be given. Ours? Oraculi.

How to use myBankStatement with Lendsqr for credit scoring

myBankStatement gives lenders access to key financial data, helping them make more informed decisions with a clearer view of borrowers' financial profiles.

How we used AWS to build our identity and liveness system

Identity verification and liveness checks are central to lending. Learn how we used AWS to build our identity and liveness system.

How we use Metabase to power our internal reporting

Metabase team deserves immense credit and we, at Lendsqr, are incredibly grateful to them. Their open-source platform is one of the best things we've ever gotten for free from the open source world.

How to set up CRC Credit Bureau for Lendsqr

One of the most critical tools you must have in your arsenal as a lender, is a credit bureau(s). Learn how to set up CRC Credit Bureau for Lendsqr.