💳 Team expense requests on the admin console

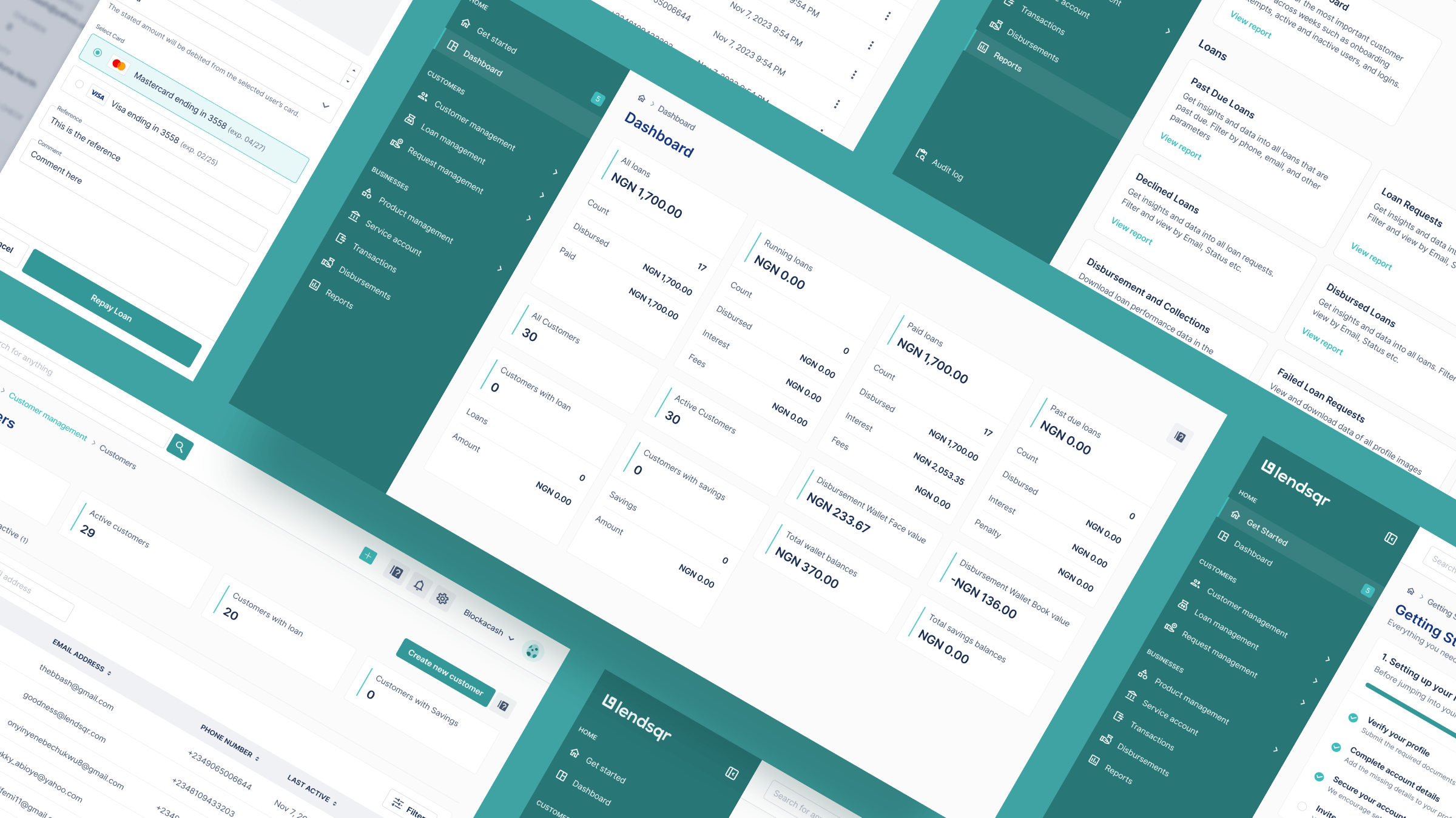

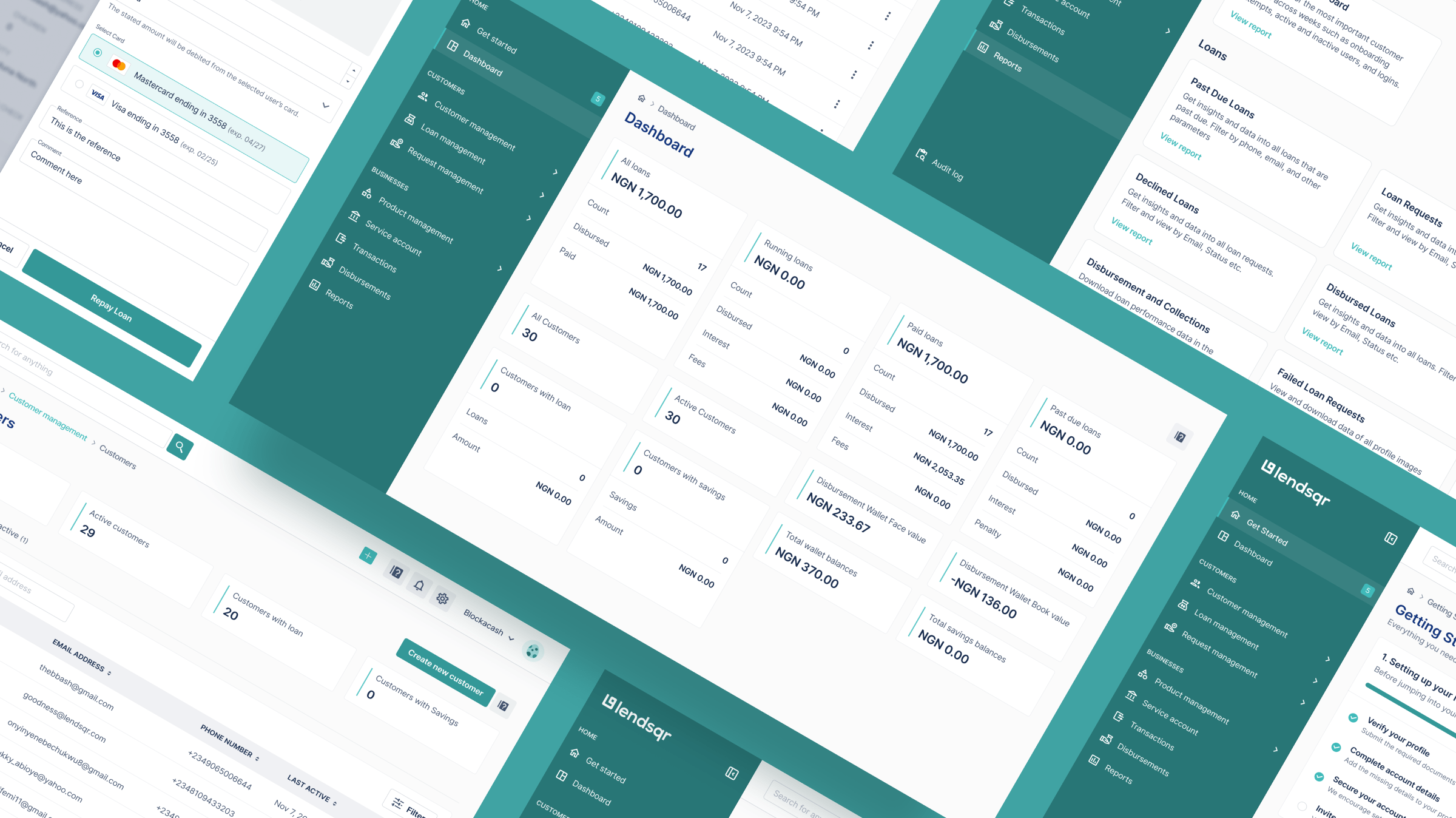

Hello there! 👋 Lending operations don’t usually break in obvious ways. They break through failed disbursements, disputes, repayment adjustments, schedule changes, and last-minute escalations that compound as your loan book grows. This month’s updates focus on reducing those moments. We’ve shipped improvements that give you better control over repayments, adjustments, receipts, internal expenses, and portfolio-wide […]

What you should expect from Lendsqr in 2026

Hello there! 👋 Happy New Year and welcome to 2026! 🌞 Before we talk about what’s next, we want to say a sincere thank you for entrusting your business to Lendsqr. Your feedback played a huge role in shaping the platform in 2025, and for many of you, choosing Lendsqr proved to be one of […]

💬We’re bringing lending and banking to WhatsApp

Hello there! 👋 Happy new month and welcome to December! 🌞 We’ve finally made it to the last month of 2025 and what a journey it has been! Time truly does fly, and it’s a gentle reminder that we should make the most of every moment. With this in mind, Lendsqr is excited to wrap […]

💪🏾 We partnered with Herconomy to give women a better future

Hello there! 👋 Happy new month and welcome to November! 🌞 November is here, reminding us that while the year may be winding down, the opportunities are not. As the days grow shorter, the chance to expand your lending business is still within reach. Whether you’re considering introducing new loan products, fine-tuning your existing ones, […]

📝 Design your forms, just the way you want it

Hello there! 👋 Happy new month and welcome to October! 🌞 To our amazing lenders in Nigeria, we’re also wishing you a Happy Independence Day! 🇳🇬✨ October is not just the start of another month. It is the beginning of the final quarter of the year, a perfect moment to pause, reflect on how far […]

💡 Give your customers flexible access to funds with overdraft

Hello there! 👋 Happy new month and welcome to September! 🌞 Two thirds of the year are already behind us. Back in January, many of us set ambitious plans and goals; September is the time to bring those intentions full circle, measure results, and push forward to finish strong. 💪 For us at Lendsqr, it’s […]

📖 Docs.lendsqr.com is live with fresh guides and documentation

Hello there! 👋 Happy new month and welcome to August! 🌞 Just like that, 7 out of 12 months are in the rearview mirror, and the countdown to year-end has officially begun. For us at Lendsqr, this is a time to refine and refocus as we work to ensure you have the tools and support […]

🔄 Top up loans without starting from scratch

Hello there! 👋 It’s July. New month, new quarter, and a new half year. A good point to step back, refocus, and pick up the pace. Whether the last quarter felt like a mad dash or a lazy stroll, the next six months will decide how the year closes. Maybe you need to tighten your […]

💡 Your customers can now choose how they want to fund their savings 🆖

Hello there! 👋 Happy new month and welcome to June! Can you believe we’re already at the halfway mark of 2025? With just one month left in Q2, it’s the perfect time to evaluate the year and reprioritize if required. Remember the goals you set at the start of the year? How are they coming […]

💳 We now support direct debit in loan invites and guarantor verification

Hello there! 👋 Happy New Month and welcome to February ❤️, the month of love, growth, and fresh starts! At Lendsqr, we’re here to ensure your hard work pays off. To support you, this month’s newsletter is packed with important updates designed to turbocharge your loan business. Here’s to a February filled with meaningful strides, […]

A look back at 2024 and what’s coming in 2025 🚀

“Success is not final, failure is not fatal: It is the courage to continue that counts.” – Winston Churchill As we step into this new year, we want to take a moment to reflect. 2024 was a remarkable year for us at Lendsqr, filled with achievements, valuable lessons, and opportunities for growth. We’re confident that […]