6 practical tips to reduce loan processing times

Fast loan processing doesn’t mean approving all loan requests, but deciding if a loan should be approved or not shouldn’t take forever.

5 best Paystack alternatives for card payment in Nigeria

When it comes to getting paid as a lender, having a dependable card payment solution is paramount. So, if you're curious to find the right fit for your lending business, come along.

How to obtain a lending license in Rwanda

As a lender getting the hang of the lending industry in Rwanda today, a thorough understanding of the legal frameworks is required.

10 intriguing facts about Lendsqr

Lendsqr is way more than a loan management platform. At the core of our services is a story. One woven with threads of innovation and, some might say intrigue.

What collateral do you need to protect your loan business?

Lenders need to be smart about what kind of collateral they accept, but they also want to make sure that all sorts of businesses and people have a chance to get the loans they need to grow.

How to use Route Mobile with Lendsqr for sending SMS

Once you have your Route Mobile API key, log in to your Lendsqr account. Reach out to our product support team at support@lendsqr.com and get set up in 10 minutes.

How we used AWS to build our identity and liveness system

Identity verification and liveness checks are central to lending. Learn how we used AWS to build our identity and liveness system.

5 types of lending model

A lending model is a lender’s map. Let’s take a look at some of the lending models available to lenders.

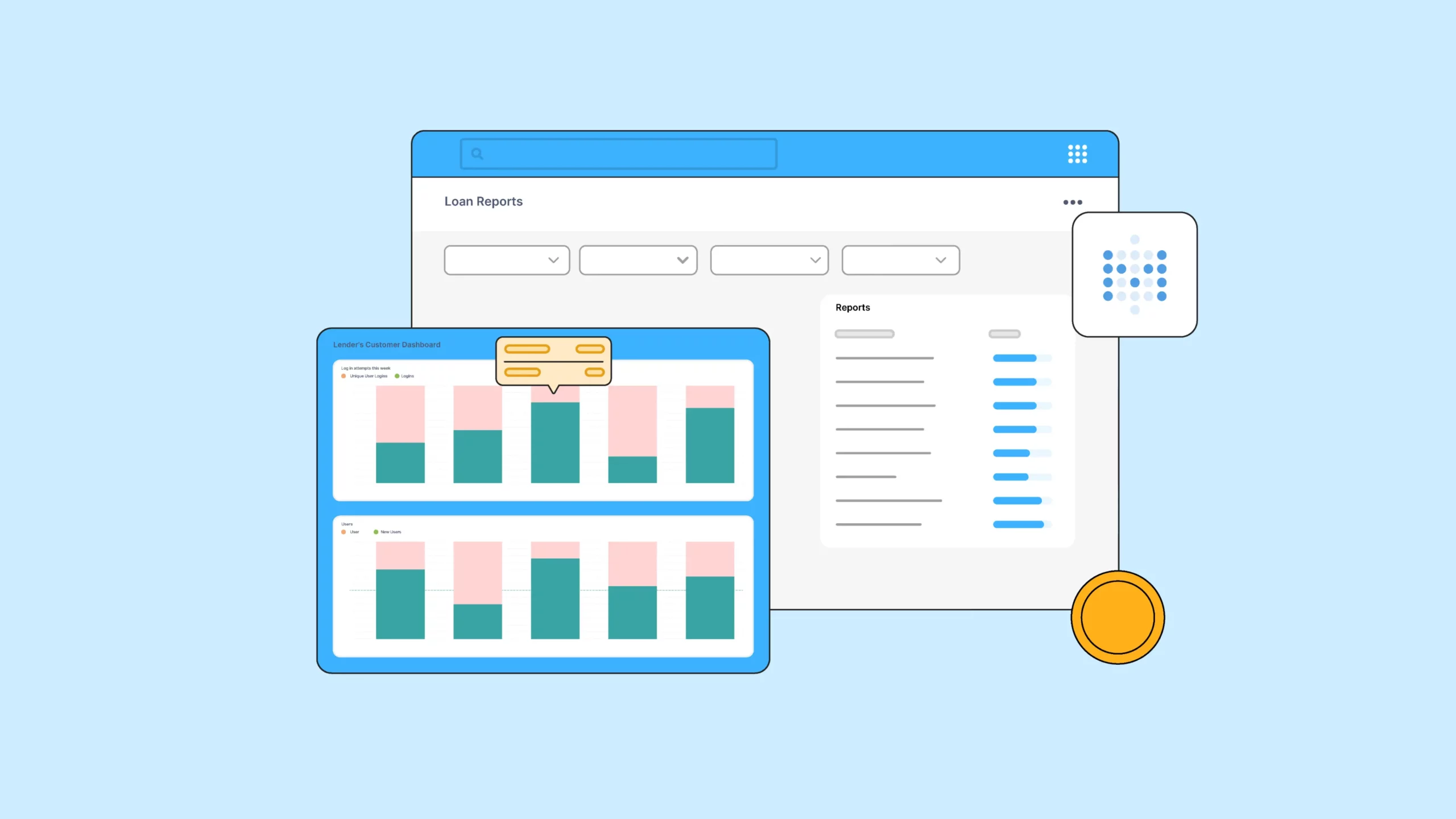

How we use Metabase to power our internal reporting

Metabase team deserves immense credit and we, at Lendsqr, are incredibly grateful to them. Their open-source platform is one of the best things we've ever gotten for free from the open source world.

How to set up CRC Credit Bureau for Lendsqr

One of the most critical tools you must have in your arsenal as a lender, is a credit bureau(s). Learn how to set up CRC Credit Bureau for Lendsqr.

How we built our URL shortener (Monstrator) as a replacement for Bitly

Monstrator stands as a testament to our in-house development capabilities, demonstrating our ability to solve critical business problems with custom-built solutions.